Altcoin revolution in August 2025: lessons for the months ahead

The “altcoin revolution” of August 2025 reshaped market balance. Binance Research dissected why Bitcoin lost ground while Ethereum surged. Now the question: does the uprising continue this fall?

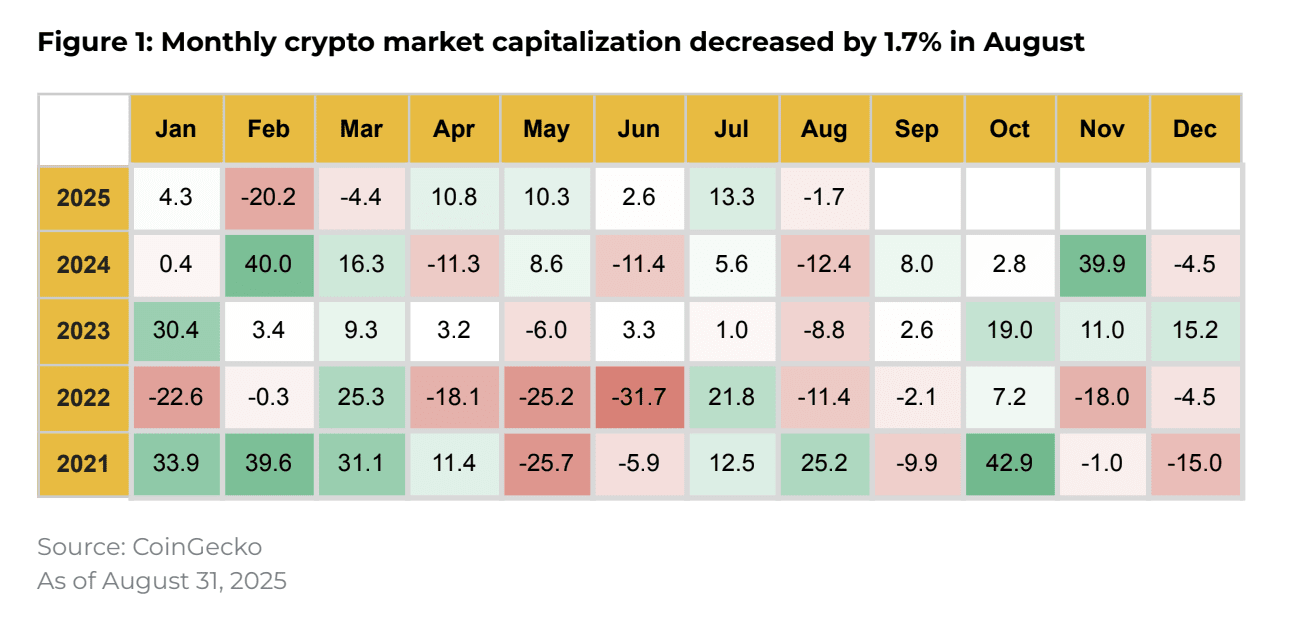

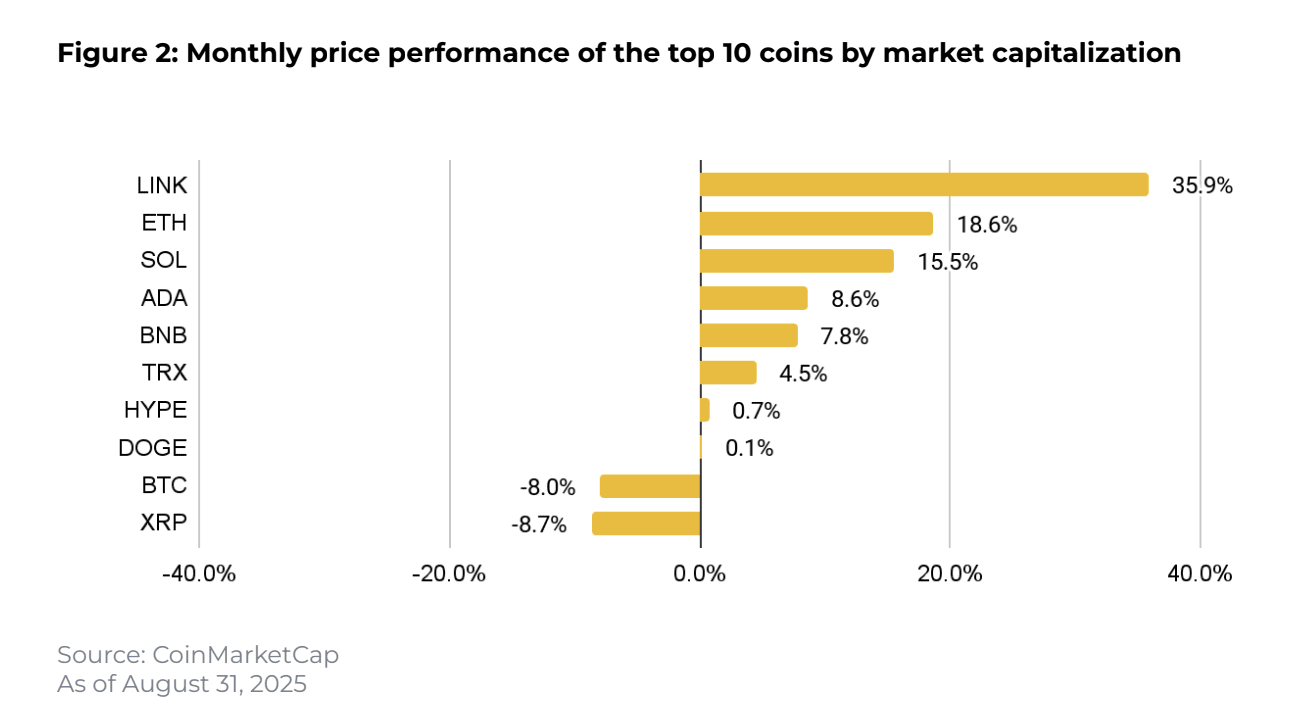

While traditional Bitcoin maximalists mourn the 8% drop of their “digital gold,” smart money has already rotated into altcoins. August Binance Research data shattered expectations: the total market fell only 1.7% while BTC crashed 8%. This represents a fundamental shift in capital distribution patterns.

Top three leaders destroy stereotypes

Chainlink: +35.9% – the state chose decentralization. The US government now officially publishes GDP data through LINK blockchain oracles. This partnership signals recognition of decentralized infrastructure superiority over legacy systems. Japan follows through SBI Group, launching real-world asset tokenization across the Asia-Pacific region.

Ethereum: +18.6% – corporate America embraces ETH. Bitmine spent $9 billion on ETH in six weeks. Public companies now hold a record 4.44 million ETH, representing 3.67% of total supply. ETH is positioning itself as the institutional alternative to Bitcoin in corporate treasuries.

Solana: +15.5% – technology delivers results. The Alpenglow upgrade proved that when technology promises become reality, markets respond immediately. Corporate treasuries and DeFi protocols increasingly demand enterprise-grade infrastructure, and Solana continues to deliver.

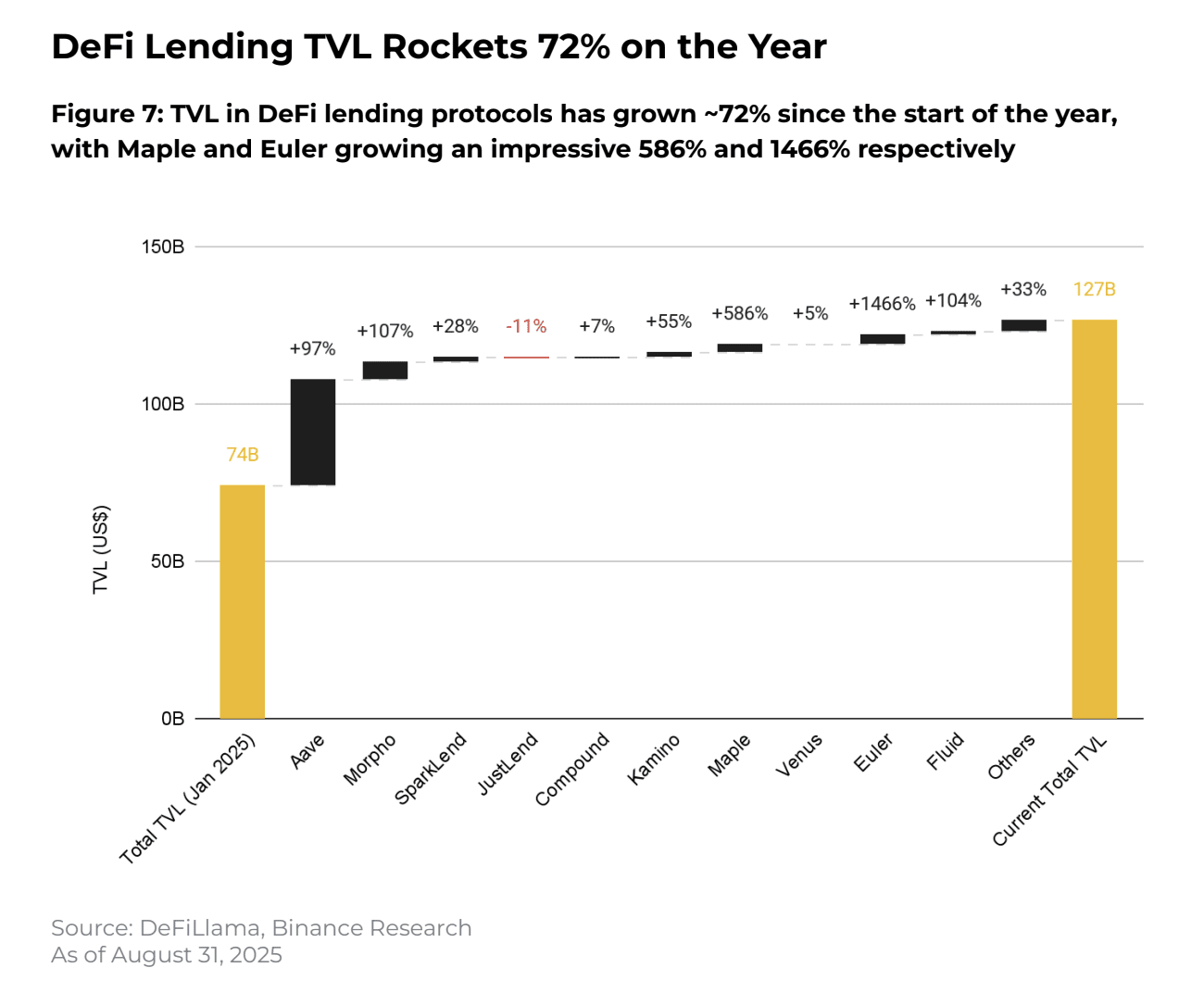

DeFi explodes: $127 billion TVL

The 72% year-over-year growth represents more than expansion – it’s a complete transformation. While banks struggle with inflation, DeFi protocols added $12 billion in a single month. Maple and Euler showed 586% and 1,466% growth respectively, each crossing the $3 billion TVL threshold.

The “experimental” phase is over. DeFi has become the new financial infrastructure.

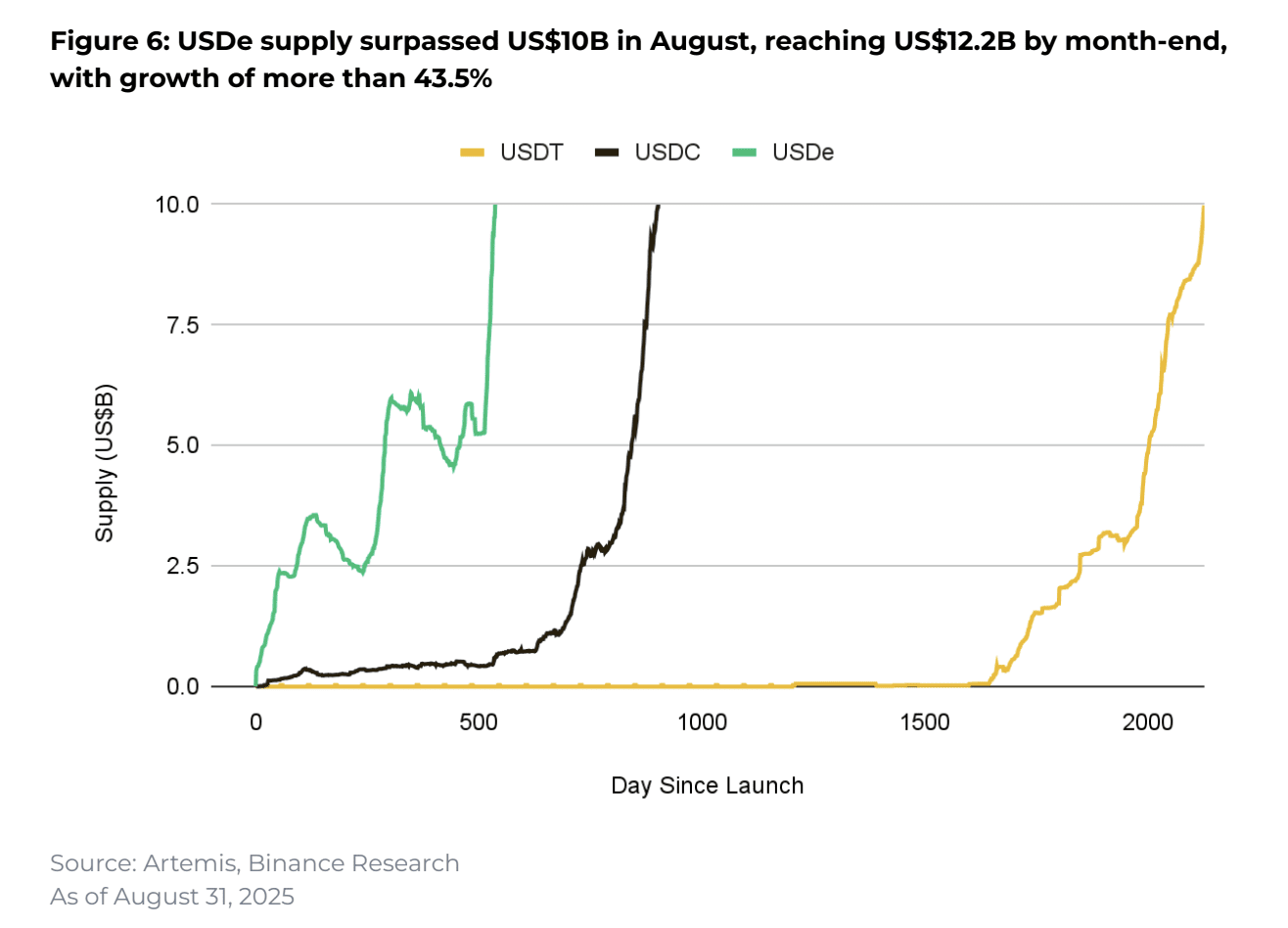

USDe: the stablecoin that broke all records

Ethena’s USDe reached $10 billion in just 536 days, compared to USDC’s 903 days and USDT’s 2000+ day timeline. USDe functions as a yield-generating asset that redefines stability itself. The 43.5% August growth to $12.2 billion demonstrates what happens when innovation meets genuine market demand.

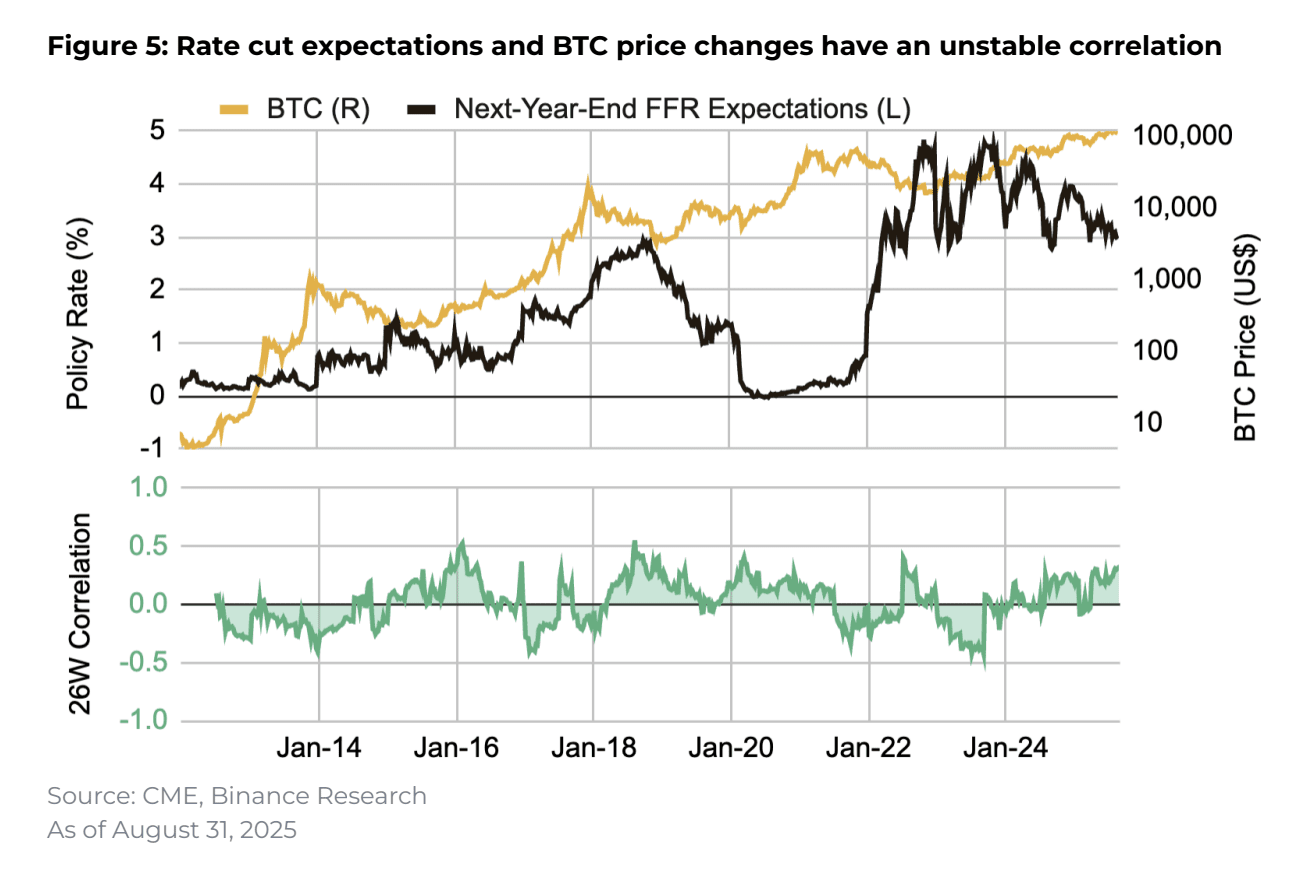

Death of correlations: the Fed no longer rules crypto

The Fed rate myth was destroyed. Binance Research’s 26-week analysis demolished the Bitcoin-Fed correlation legend. The coefficient of determination sits near zero. While traditional traders wait for Powell’s decisions, sophisticated investors focus on institutional adoption, technological breakthroughs, and real project utility.

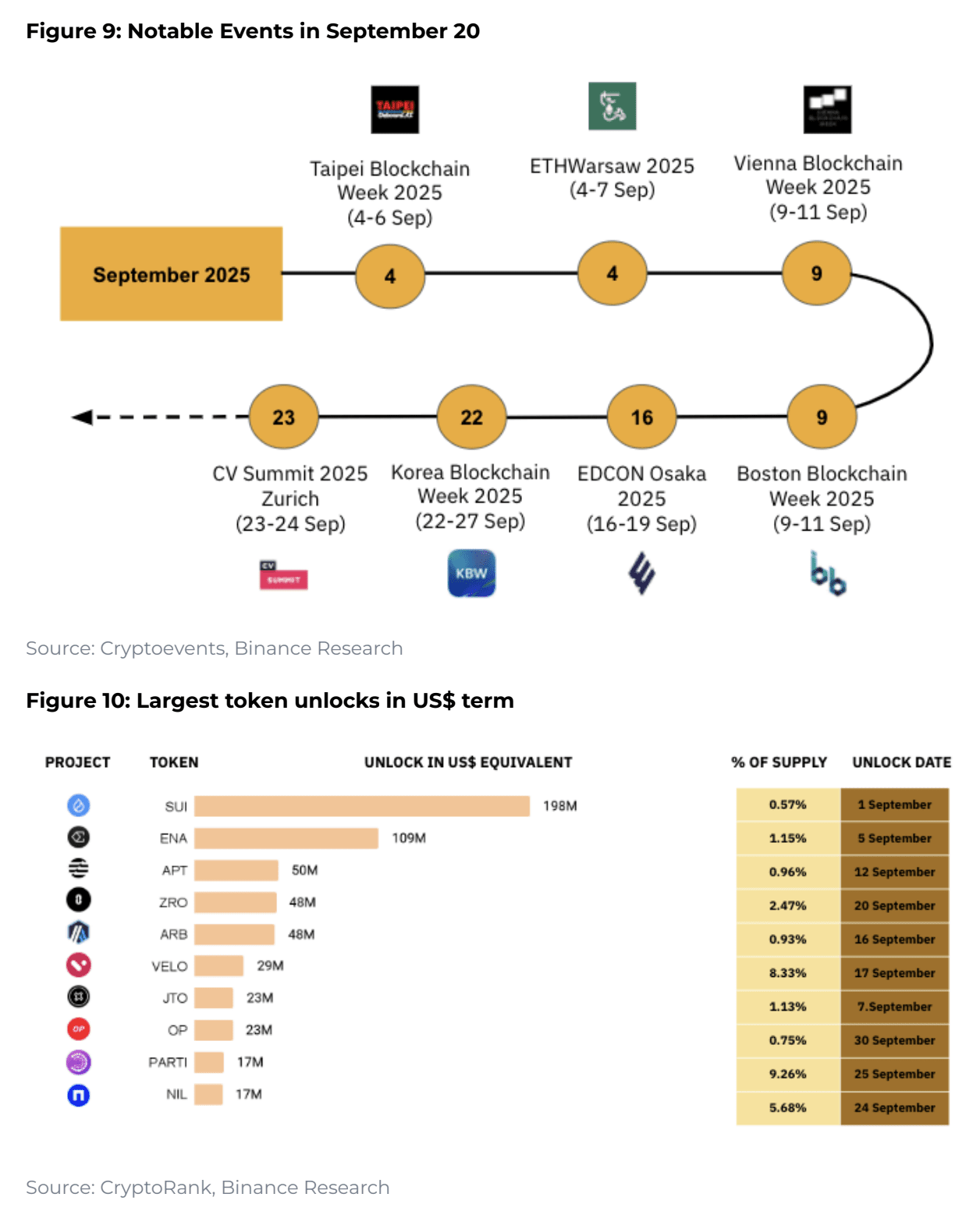

September: the final test before takeoff

September historically represents a weak month for crypto, and token unlocks worth over $4 billion are approaching. However, this period will separate empty projects from future market leaders.

Survival depends on real utility, institutional backing, and growing ecosystems rather than speculative momentum.

Altcoin season is just beginning

August confirmed the end of pure speculation and the beginning of the utility era. Chainlink captures government infrastructure contracts. Ethereum becomes the corporate treasury standard. USDe rewrites stablecoin functionality while DeFi systematically replaces traditional finance.

The critical question isn’t whether altcoins can maintain August gains. The question is readiness for the next wave as institutional adoption transitions from experimental phase to industry standard.

Read the full research here.

The information published on CoinRevolution is intended solely for general knowledge and should not be considered financial advice.

While we aim to keep our content accurate and current, we make no warranties regarding its completeness, reliability, or precision. CoinRevolution bears no responsibility for any losses, errors, or decisions made based on the material provided. Always do your own research before making financial choices, and consult with a qualified professional. For more details, refer to our Terms of Use, Privacy Policy, and Disclaimers.