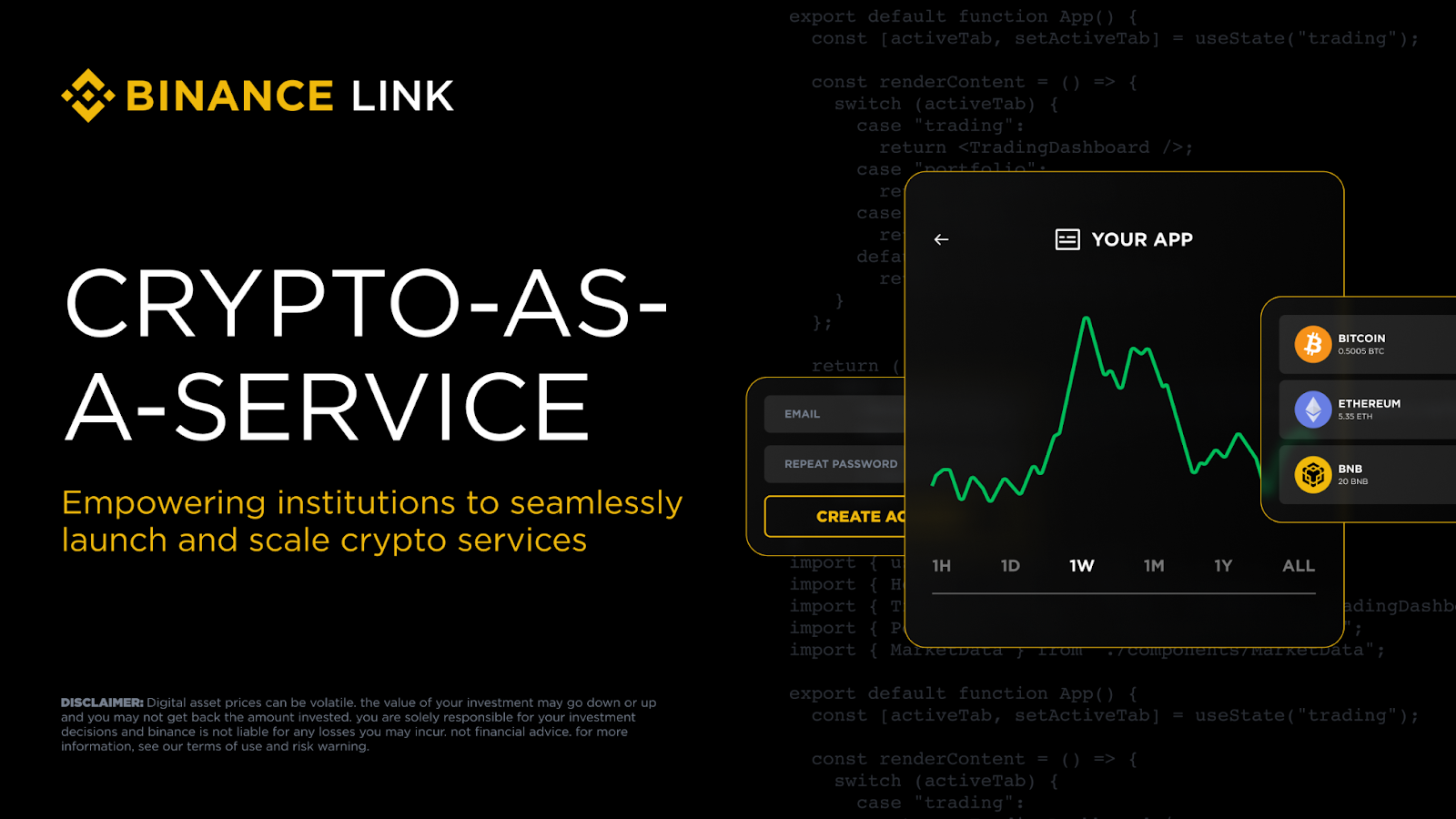

Binance launches institutional crypto platform to TradFi

Traditional financial institutions can access Binance’s crypto infrastructure without building their own, as the exchange launches a white-label service for banks and brokers.

Binance expects that traditional financial institutions seek crypto exposure but prefer not to build infrastructure from scratch. The exchange just launched Crypto-as-a-Service (CaaS), a white-label solution that lets banks and brokers offer crypto trading using Binance’s technology stack.

The move puts Binance in direct competition with other infrastructure providers while giving TradFi firms a fast-track access to crypto markets. Institutions get access to trading, custody, compliance, and clearing systems while keeping control of their brand and client relationships.

How it works

Institutions using CaaS can run crypto operations under their own branding while Binance handles the technical backend. The platform covers spot and futures markets, with built-in compliance monitoring and custody solutions.

Key features

Internal order matching: this feature allows institutions to match client orders internally before routing them to external markets. Binance claims this capability isn’t available from competitors and allows firms to capture more revenue from client activity.

Liquidity access: firms with limited internal liquidity get direct access to Binance’s order books, ensuring execution quality and tight spreads without building their own market-making operations.

Institutional controls: a management dashboard tracks volumes, onboarding, and asset flows. Institutions can manage sub-accounts, set fee structures, and configure trading parameters through a web interface or API.

Client tiering: the platform includes tools for segmenting clients, applying custom pricing, and creating differentiated service levels.

Regulatory tools: built-in KYC systems, transaction monitoring APIs, and account segregation features help institutions meet compliance requirements across jurisdictions.

Catherine Chen, Binance’s head of VIP and institutional services, says demand for crypto infrastructure has hit a point where traditional institutions can’t ignore it:

Building this from scratch is complex, expensive, and risky. Crypto-as-a-Service is a ready solution with modular architecture that integrates easily, so institutions can focus on their clients instead of infrastructure.

Chen positioned the platform as a bridge between traditional finance and crypto, aimed at bringing in users who haven’t engaged with digital assets before.

Binance opened early access on September 30, 2025, limited to licensed banks, brokers, and exchanges that meet scale requirements. The company plans to expand availability in Q4 to a broader range of institutions.

Interested financial organizations can contact Binance’s institutional team for partnership discussions.

https://www.binance.com/uk-UA/vip-portal

Press contact: Alina Steklova, [email protected]

The information published on CoinRevolution is intended solely for general knowledge and should not be considered financial advice.

While we aim to keep our content accurate and current, we make no warranties regarding its completeness, reliability, or precision. CoinRevolution bears no responsibility for any losses, errors, or decisions made based on the material provided. Always do your own research before making financial choices, and consult with a qualified professional. For more details, refer to our Terms of Use, Privacy Policy, and Disclaimers.